AGTEGRA ADVANTAGE FINANCING

Qualify for low interest crop protection and seed financing and earn a 4.9% interest rate on fall applied fertilizer! Deadline to apply is November 21, 2025. Visit with your Agtegra Agronomist for qualifying products and details.

| PRODUCTS | INTEREST RATE |

|---|---|

| Crop Protection (Excludes glyphosate. Must hold or grow CP purchases to qualify) | 0% fixed interest until Nov 30, 2026 |

| Seed (Must hold or grow seed purchases to qualify) | 1.9% fixed interest until Nov 30, 2026 |

| Fall-Applied Fertilizer (Must hold or grow seed and crop protection purchases to qualify. Valid on fertilizer invoiced between Aug. 1, 2025 - Jan. 22, 2026) | 4.9% fixed interest until Nov 30, 2026 |

Loan maximum: $850,000. Higher maximum available with additional approval. Loan matures: Feb. 10, 2027

CHS Capital Accolade Standard Variable Interest Rate from Dec. 1, 2026 - Feb. 10, 2027.

AGTEGRA ADVANTAGE 0% FINANCING

Customers may apply for 0% financing on crop protection and low interest financing on seed. Deadline to apply is November 15, 2024.

| PRODUCTS | INTEREST RATE |

|---|---|

| Crop Protection | 0% fixed interest until Nov 30, 2025 |

| Seed (NK) | 0% fixed interest until Nov 30, 2025 |

| Seed (Dekalb, Asgrow, Brevant) | 2.9% fixed interest until Nov 30, 2025 |

Loan maximum: $850,000. Higher maximum available with additional approval. Loan matures: Feb. 10, 2026

CHS Capital Accolade Standard Variable Interest Rate from Dec 1, 2025 - Feb 10, 2026

CHS CAPITAL LOAN

A CHS Capital loan offers am easy application, and a one-stop shop for financing all inputs.

Qualifying Purchases | Loan Maximum | Interest | Application Deadline | Maturity Date |

|---|---|---|---|---|

Seed, Crop Protection, Fertilizer, Ag Technology, Custom Application, Fuel, Feed 7 Farm Supply, Innovation Center | $850,000 Higher maximum available with additional approval. | 9.0% variable interest rate until November 30, 2025 CHS Capital Accolade Standard Variable Interest Rate from December 1, 2025 - February 10, 2026 | Jan. 22, 2025 | Feb. 10, 2026 |

Variable interest rates are based on the CHS Capital Accolade Standard Base Rate, which was 9.0% as of October 1, 2024. CHS Capital interest rate indices are published at www.agtegra.com/financing. $100 application fee.

WINFIELD UNITED SECURE

A Secure loan offers low interest financing on Croplan seed and Winfield United crop protection. Apply early - this loan is only available until November 20, 2024.

Eligible Products | Loan Maximum | Interest | Application Deadline | Maturity Date |

|---|---|---|---|---|

Croplan Corn & Soybean Seed | $500,000 Higher maximum available with additional approval | 2.99% fixed interest rate for A 4.99% fixed interest rate for B until November 30, 2025 Prime +2% Variable Interest Rate from December 1, 2025 - February 1, 2026 | Nov. 20, 2024 | Feb. 1, 2026 |

Croplan Alfalfa, Sunflowers & Milo Seed & Winfield United Crop Protection | $500,000 Higher maximum available with additional approval | 3.99% fixed interest rate for A 5.99% fixed interest rate for B until November 30, 2025 Prime +2% Variable Interest Rate from December 1, 2025 - February 1, 2026 | Nov. 20, 2024 | Feb. 1, 2026 |

$250 application fee.

INNOVATION CENTER FINANCE PROGRAM

Growers may utilize Agtegra to finance their Innovation Center equipment upgrade purchases at 0% fixed interest. The loan is paid over 2 years: first payment plus origination fee at time of project completion, second payment at the 12-month anniversary of project completion and third payment at the 24-month anniversary. 3% origination fee of the total amount is due at time of first payment. Bid must be signed by January 22, 2025. Financed projects must be between $5,000 - $150,000.

Qualifying Purchases | Loan Maximum | Interest | Application Deadline | Maturity Date |

|---|---|---|---|---|

Seed & Crop Protection | $850,000 Higher maximum available with additional approval | 0% fixed interest rate until November 30, 2024 CHS Capital Accolade Standard Variable Interest Rate from December 1, 2024 – February 10, 2025 | November 17, 2023 | February 10, 2025 |

Variable interest rates are based on the CHS Capital Accolade Standard Base Rate, which was 9.5% as of August 1, 2023. CHS Capital interest rate indices are published below. $100 application fee.

CHS CAPITAL LOAN

A CHS Capital loan offers stability with a low fixed interest rate for seed and crop protection and an affordable interest rate on other inputs. Apply early - this loan is only available until January 22, 2024!

Qualifying Purchases | Loan Maximum | Interest | Application Deadline | Maturity Date |

|---|---|---|---|---|

Seed & Crop Protection | $850,000 Higher maximum available with additional approval | 4% fixed interest rate until November 30, 2024 CHS Capital Accolade Standard Variable Interest Rate from December 1, 2024 - February 10, 2025 | January 22, 2024 | February 10, 2025 |

Fertilizer, Ag Technology, Custom Application, Fuel, Feed/Farm Supply, Innovation Center | $850,000 Higher maximum available with additional approval | 8.25% variable interest rate (CHS Capital Accolade Standard Variable Interest Rate less Agtegra investment of 1.25%) until November 30, 2024 (CHS Capital Accolade Standard Variable Interest Rate from December 1, 2024 - February 10, 2025) | January 22, 2024 | February 10, 2025 |

Variable interest rates are based on the CHS Capital Accolade Standard Base Rate, which was 9.5% as of August 1, 2023. CHS Capital interest rate indices are published below. $100 application fee.

CFA LOAN

The Cooperative Finance Association, Inc. (CFA) loan can be used towards almost any Agtegra input purchase.

Qualifying Purchases | Loan Maximum | Interest | Application Deadline | Maturity Date |

|---|---|---|---|---|

Fertilizer, Ag Technology, Custom Application, Seed, Crop Protection, Fuel, Feed/Farm Supply | $600,000 Higher maximum available with additional approval | 8.25% variable interest rate until December 31, 2024 CFA Field Finance Variable Interest Rate + 1.25% from January 1, 2025 - February 15, 2025 | April 30, 2024 | February 15, 2025 |

CFA loan customers are limited to one CFA loan per crop year. Variable interest rates are based on the CFA Field Finance Rate, which was 8.25% as of August 1, 2023. CFA interest rate indices are published at www.cfafs.com/financials. $200 application fee.

PURINA FEED FINANCING

Optimize your cash flow and embrace the flexibility of zero payments for up to six months during the enrollment period with the 6-4-0 Feed Financing Program.

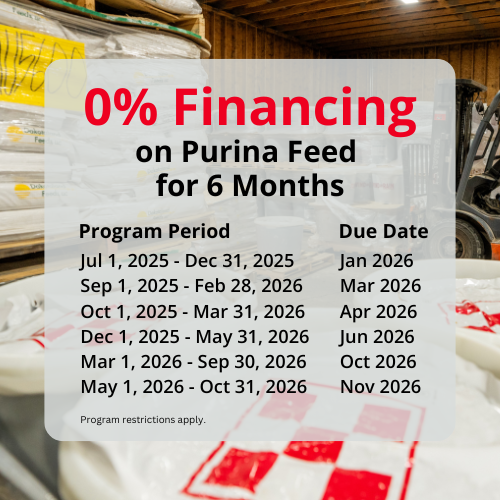

0% Purina Feed Financing

Finance your Purina feed purchases at 0% interest for 6 months with a John Deere Financial Multi-Use Account.

RATES FOR 2026 LOANS

Agtegra CHS Capital Accolade Standard Rate

7.25%

RATES FOR 2025 LOANS & PRIOR

| Rate | Date Effective |

| 6.25% | July 1, 2022 |

| 7.0% | August 1, 2022 |

| 7.75% | October 1, 2022 |

| 8.5% | December 1, 2022 |

| 9.0% | January 1, 2023 |

| 9.25% | April 1, 2023 |

| 9.5% | August 1, 2023 |

| 9.0% | October 1, 2024 |

| 8.75% | December 1, 2024 |

| 8.5% | October 1, 2025 |

| 8.25% | December 1, 2025 |

PARTNER PROGRAMS

SECURE BY WINFIELD

Some of your most important decisions on the farm are financial decisions. This season, choose SECURE™ financing from WinField® United for low fixed interest rates and industry-leading maturity dates that help you take advantage of valuable crop marketing and tax benefits.

CORTEVA TRUCHOICE

With the TruChoice® offer, save big on crop protection products from Corteva Agriscience when you fund a prepay account.

RABO AGRIFINANCE

Input financing that provides an incremental line of capital to purchase your inputs and flexible payment options that can help improve your operation’s cash flow.

JOHN DEERE FINANCIAL

Get ag financing that allows you to lock in crop input purchases and free up operating cash, all while not paying a thing until after you harvest.