Carbon Markets – Breaking down the hype!

May 12, 2022

Carbon credits have become the subject of many agricultural publication advertisements over the past year and have caused many farmers to research the options of selling carbon credits or carbon offsets on farmland.

While these options can generate alternative income, what does it take to do that?

It depends! It helps to break down what the current lay of the land looks like in the carbon space to fully understand what this could like in practice.

Farmers in the Carbon Market

For a farmer to generate a certificate that allows a purchaser to release one metric ton of greenhouse gas, the farmer must prove they sequestered that same metric ton on their farm. Examples of how to implement this could include:

Two primary markets for these carbon credits and offsets exist. The first market is part of the “voluntary” consumer market. This market could include any large company that is advertising to be carbon neutral by a certain date and that has sustainability goals they would like to achieve. These companies mainly purchase carbon offsets. Because this market is primarily self-regulated, purchasing companies set the protocols or farming practice change they would like to see happen before purchasing a carbon offset from a farmer. These are the main programs advertised right now, asking farmers to switch from conventional tillage to no-till or to plant a cover crop.

While this voluntary market is self-regulated, there are clearing houses like The Gold Standard or Verra that verify and track that these carbon offsets are happening at the farm level and make sure that a farmer’s carbon offset is only sold one time during the life of the contract that was signed.

While the voluntary market pays less for a ton of carbon, it can have more flexible contract terms, such as allowing partial field tillage in a very wet year or not planting a cover crop in a very dry year. Some are even back paying producers for a practice change such as switching to no-till that happened 10 years ago.

The second market is the “compliance” consumer market. This market is heavily regulated and tracked. An example would include a large factory such as an oil refinery that is emitting large volumes of greenhouse gas emissions into the atmosphere and is under government regulation to purchase carbon credits to offset these emissions.

In both markets, one thing is consistent; the farmer can choose if they want to participate. The farmer who chooses to participate in the compliance market generally receives more per ton for the carbon credit. However, the rules of the contract may be more stringent. For example, the contract may require a farmer to be 100% no-till, even under the wettest of field conditions, or plant a cover crop under the driest of conditions.

The Carbon Market and Agtegra

The carbon offset market was worth $400 million in 2020 and is estimated to be worth $10-$25 billion by 2030. The larger, regulated carbon credit market was worth $261 billion in 2020. This creates tremendous opportunity for farmers to capture extra revenue on their operations.

Agtegra is following these markets and is trying to find solutions that can bring our patrons the most value per acre with the least amount of impact to their farms and ranches.

While these options can generate alternative income, what does it take to do that?

It depends! It helps to break down what the current lay of the land looks like in the carbon space to fully understand what this could like in practice.

Farmers in the Carbon Market

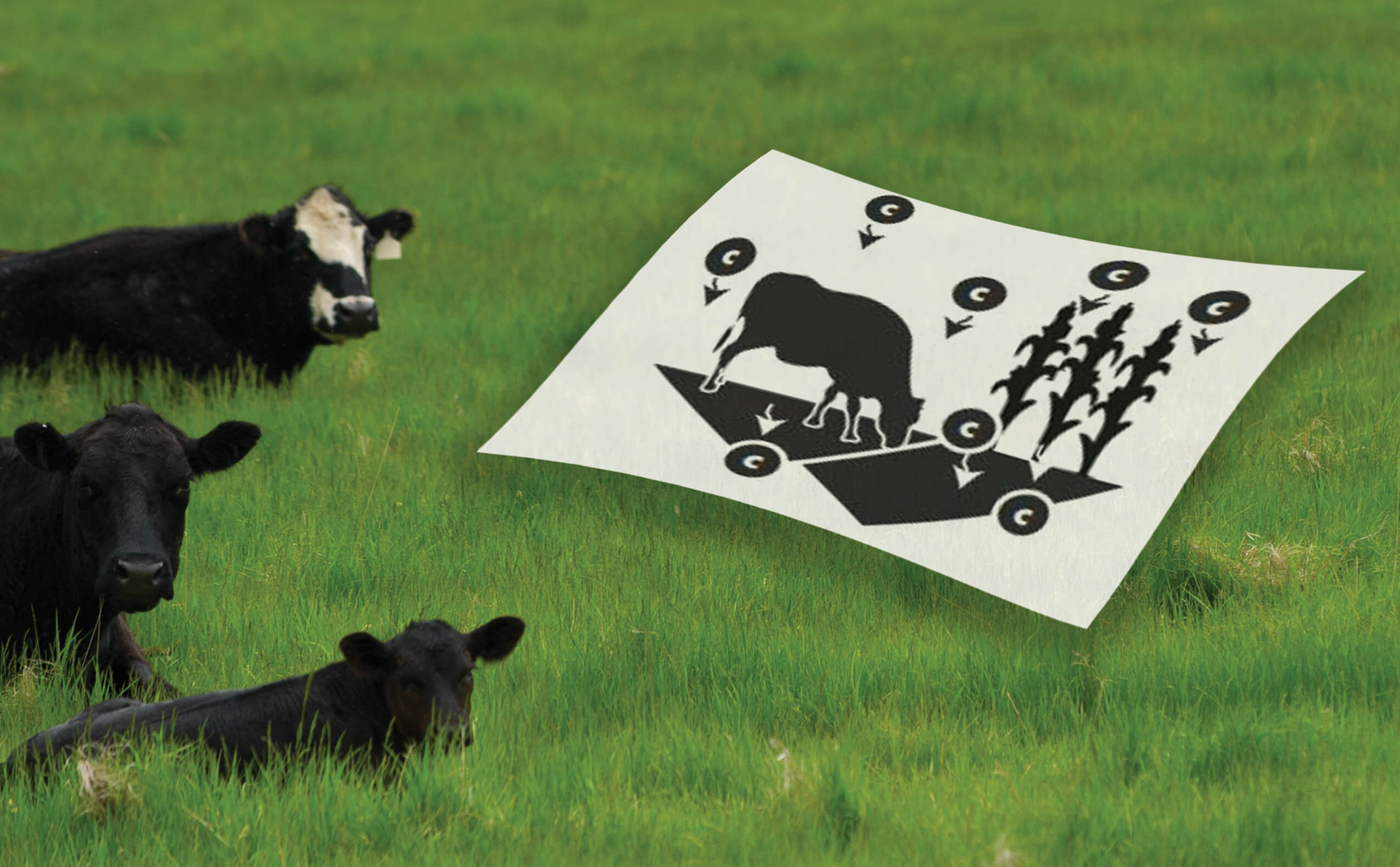

For a farmer to generate a certificate that allows a purchaser to release one metric ton of greenhouse gas, the farmer must prove they sequestered that same metric ton on their farm. Examples of how to implement this could include:

- -Reducing passes across fields and reducing CO2 emissions from equipment

- -Variable rate apply nitrogen fertilizer or use stabilizers with crop nutrition applications to reduce volatility and nitrous oxide emissions

- -Plant a cover crop or move to complete no-till to increase the amount of carbon stored in the soil rather than releasing into the atmosphere during tillage.

- -Implement rotational grazing to keep a healthy stand of grass actively growing

- -Lightly fertilize grass to produce more vegetation

- -Overseed another species of grass to create more vegetation, thus pulling extra CO2 out of the atmosphere and into the undisturbed soil

Two primary markets for these carbon credits and offsets exist. The first market is part of the “voluntary” consumer market. This market could include any large company that is advertising to be carbon neutral by a certain date and that has sustainability goals they would like to achieve. These companies mainly purchase carbon offsets. Because this market is primarily self-regulated, purchasing companies set the protocols or farming practice change they would like to see happen before purchasing a carbon offset from a farmer. These are the main programs advertised right now, asking farmers to switch from conventional tillage to no-till or to plant a cover crop.

While this voluntary market is self-regulated, there are clearing houses like The Gold Standard or Verra that verify and track that these carbon offsets are happening at the farm level and make sure that a farmer’s carbon offset is only sold one time during the life of the contract that was signed.

While the voluntary market pays less for a ton of carbon, it can have more flexible contract terms, such as allowing partial field tillage in a very wet year or not planting a cover crop in a very dry year. Some are even back paying producers for a practice change such as switching to no-till that happened 10 years ago.

The second market is the “compliance” consumer market. This market is heavily regulated and tracked. An example would include a large factory such as an oil refinery that is emitting large volumes of greenhouse gas emissions into the atmosphere and is under government regulation to purchase carbon credits to offset these emissions.

In both markets, one thing is consistent; the farmer can choose if they want to participate. The farmer who chooses to participate in the compliance market generally receives more per ton for the carbon credit. However, the rules of the contract may be more stringent. For example, the contract may require a farmer to be 100% no-till, even under the wettest of field conditions, or plant a cover crop under the driest of conditions.

The Carbon Market and Agtegra

The carbon offset market was worth $400 million in 2020 and is estimated to be worth $10-$25 billion by 2030. The larger, regulated carbon credit market was worth $261 billion in 2020. This creates tremendous opportunity for farmers to capture extra revenue on their operations.

Agtegra is following these markets and is trying to find solutions that can bring our patrons the most value per acre with the least amount of impact to their farms and ranches.